Online Banking FAQ

NEW Online Banking

Review our frequently asked questions.

We know that you likely have lots of questions about our new mobile app and online banking. To help you, we have compiled a list of frequently asked questions to help guide you through the registration process and each feature. Please select from our categories of FAQs below.

-

Register for Online and Mobile Banking

- Do I need to register if I previously used Wave’s Mobile and Online Banking?

- Do I need to re-download the mobile app?

- What do I need in order to register?

- How do I find my account number?

- I get an error that says “The information provided does not match our records.” What do I do?

- The contact information listed on my account is incorrect. What do I do?

- Can business and trust accounts register?

- What is a security image and security phrase?

1. Do I need to register if I previously used Wave’s Mobile and Online Banking?

Yes. Since this is an entirely new mobile app and online banking system, you will need to register as a new user. You will be able to select your preferred user name.

2. Do I need to re-download the mobile app?

Yes. You will need to download our new app from your app store. Simply search for Wave Federal Credit Union and download our new app with the light blue icon.Or, you can select the app store for your device below.

3. What do I need in order to register?

You will need your account number and personal information (e.g. birthdate and social security number) to register.

4. How do I find my account number?

Your account number is located on the membership ID card you were issued at the time you opened your Wave FCU account. You can also find your account number on your monthly/quarterly statement.

5. I get an error that says “The information provided does not match our records.” What do I do?

First, check that you have entered your account number and personal information correctly. If you still are having problems, please contact us at 401-781-1020 during regular business hours. You may have to visit one of our locations if the information that we have on file for you is incorrect.

6. The contact information listed on my account is incorrect. What do I do?

You can update your contact information within online banking after you have registered and logged in. You can do this under Profile and Settings in online banking, or under Contact Information within the mobile app.

7. Can business and trust accounts register?

Yes. Business owners will need their TIN and account number to get started. Trust account owners will need their trust account number and trustee personal information.

8. What is a security image and security phrase?

The security image and phrase are added safety features that you will customize during registration. They serve as important visual cues when you are logging in to Wave’s online banking. Sometimes hackers will try to replicate a financial institution’s online banking site in order to trick members into entering their account information into a fake site. The security image and phrase helps protect against this.Each time you log in to online banking from a web browser, you should look for your security image and phrase. If you do not see them, do not log in. The security image and phrase is specific to online banking, so you will not see these items on the mobile banking app.

-

Login

- How do I log in for the first time?

- The PIN is being sent to a phone number or email that I no longer have access to. What do I do?

- How can I log in using my fingerprint or facial recognition?

1. How do I log in for the first time?

When you log in for the first time, or from a new device, you will be asked to have a One Time PIN delivered to you via email or phone. Simply retrieve and input the PIN to finish logging in..

2. The PIN is being sent to a phone number or email that I no longer have access to. What do I do?

You will need to update your contact information with the credit union. You can do this in person at any branch or give us a call at 401-781-1020.

3. How can I log in using my fingerprint or facial recognition?

First, you must have Wave’s Mobile App installed on your device. Then, you must enable fingerprint or facial recognition under Settings and Biometrics. Once you do so, you can then use your fingerprint or facial recognition to log in to the mobile app or online banking via Quick Login. -

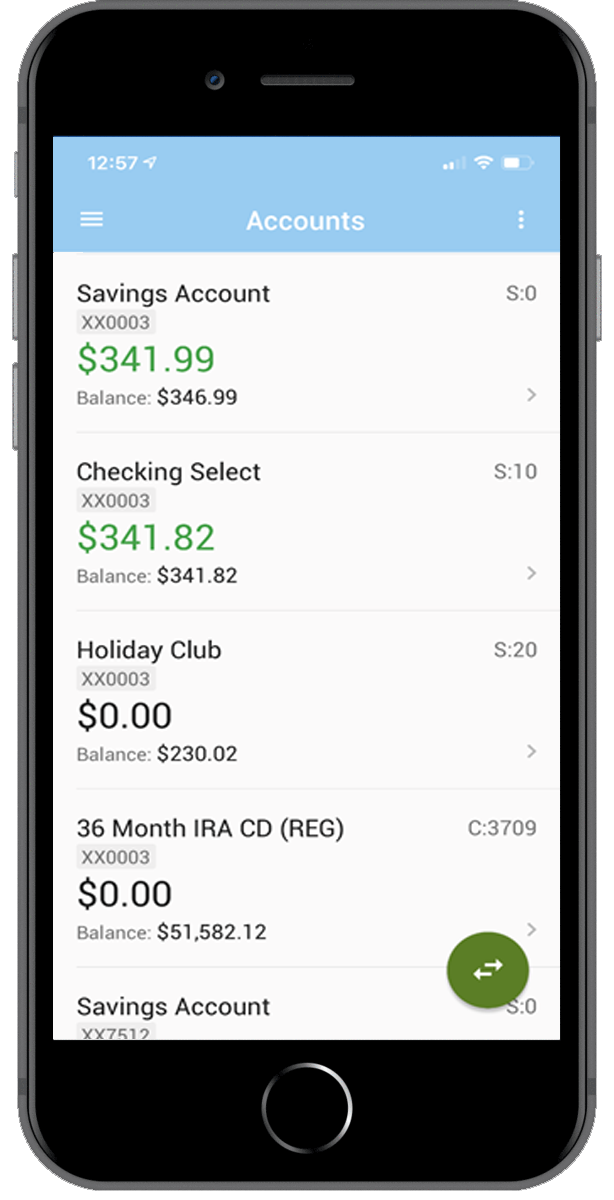

Manage Alerts

- Will my alerts carry over from the previous online banking?

- How do I set up alerts?

- On which accounts can I set alerts?

- Where can I have account alerts delivered?

- What type of alerts can I set up?

1. Will my alerts carry over from the previous online banking?

No, alerts will not carry over to the new mobile app or online banking. You will need to set up them up again.

2. How do I set up alerts?

You can set up alerts in online banking under Messages & Alerts or in the mobile app under Manage Alerts.

3. On which accounts can I set alerts?

You can set up alerts for any of your savings accounts or loans. You can also set up general alerts to notify you when your log in credentials change or when a password reset has been requested.

4. Where can I have account alerts delivered?

You can have alerts delivered as a text to your cell phone, an email, and/or as an app notification.

5. What type of alerts can I set up?

There are many types of alerts that you can set up, including low balance, large transactions, loan payment due, and more. -

Transfer Money and Make Payments

- Will the transfers and payments that I had set up in the previous system carry over?

- How do I transfer money between my accounts on the same membership?

- Can I transfer money to another Wave member?

- Can I transfer money to another Wave account that I am an owner of?

- Can I transfer money to my non-Wave account?

- Can I transfer money to someone who is not an Wave FCU member?

- How do I make a loan payment?

- Can I set up automated loan payments?

- How can I get a pay-off for my loan?

1. Will the transfers and payments that I had set up in the previous system carry over?

If you had bill payments set up in the previous online banking system, they will continue as scheduled. Transfers set up previously by members through online banking, will need to be set up again.

2. How do I transfer money between my accounts on the same membership?

In online banking, select Transfers & Payments from the left-hand navigation. On the Make a Transfer or Payment screen, you will need to select where the money is coming from (section 1) and then where you want the money to go to (section 2). Once you do that, you will be able to specify how much you want to transfer and when (section 3).In the mobile app, select Transfers from the left-hand or pop-up menus. Then, select where the money is coming from and where you want the money to go to from the drop downs. Once you do that, you will be able to specify how much you want to transfer and when.

3. Can I transfer money to another Wave member?

Yes. Simply follow the steps for performing a transfer and, when you select where you want the money to go to, select Another Member from the bottom of the list of accounts. In order to send money to another Wave member, you will need to know their account number and last name. If you do not know this information, you can send them money via Allied Payment P2P using your Wave checking account.

4. Can I transfer money to another Wave account that I am an owner of?

Yes. The easiest way is to Link Memberships so that all of the memberships that you are an owner of appear under your username. Or, you can follow the steps for performing a transfer and, when you select where you want the money to go to, select Another Member from the bottom of the list of accounts. Then input the other account number and last name on the account.

5. Can I transfer money to my non-Wave account?

Yes. Simply follow the steps for performing a transfer and, when you select where you want the money to go to, select An External Account from the bottom of the list of accounts. In order to send money to an external account, you will need to know the bank name, routing number, account number and type of account.

6. Can I transfer money to someone who is not an Wave member?

Yes. You can send money from your Wave checking account to nearly anyone, anywhere by using Wave's Send Money feature (person-to-person payments), which is powered by Allied Payment P2P.In the mobile app, select Send Money from the left-hand or pop-up menus. Then, select which account the money should come from, along with how much. You will then need to enter the recipient's email or mobile phone number.

In Online Banking, select Transfers & Payments from the left-hand navigation. On the Make a Transfer or Payment screen, you will need to select your checking account as where the money is coming from (section 1). Then, select Any Phone or Email as where you want the money to go to (section 2). Then, input the recipient’s name, email address or phone number, and the country (section 3). You can then specify how much you want to send and how you want to send it.

7. How do I make a loan payment?

In online banking, select Transfers & Payments from the left-hand navigation. On the Make a Transfer or Payment screen, you will need to select where the money is coming from (section 1) and then select which loan you would like to pay (section 2). Once you do that, you will be able to specify how much you want to transfer and when (section 3).In the mobile app, select Transfers from the left-hand or pop-up menus. Then, select where the money is coming from and which loan you would like to pay from the drop downs. Once you do that, you will be able to specify how much you want to transfer and when.

8. Can I set up automated loan payments?

Yes. Automated loan payments can be set up in online banking. Simply follow the steps for performing a transfer and select Recurring Transfer after you specify how much you want to pay (section 3). You can then choose when you want your payments to start, how frequently you want to make payments, and when you want them to end.

9. How can I get a pay-off for my loan?

You can get same-day loan payoff information from the Accounts Overview screen. Click the loan account you want to get more information on. You will then see an option for “Pay Off”. This quote will include all accrued interest and is valid for same-day payoff amounts only. -

Send Money Allied Payment P2P

- How does Wave’s Send Money feature (person-to-person payments) work?

- Does the person I’m sending money to need to have an Wave FCU account?

- How do recipients actually get the money?

- Will recipients be able to see my Wave account information?

- What happens if I send money, but the recipient doesn’t get it?

- How long does it take the recipient to get the money?

- How much does it cost to send money?

- What happens to unclaimed payments?

1. How does Wave's Send Money feature (person-to-person payments) work?

In the mobile app, select Send Money from the left-hand or pop-up menus. Then, select which account the money should come from, along with how much. You will then need to enter the recipient's email or mobile phone number.In Online Banking, select Bill Pay from the left-hand navigation. Then, select "I want to" and use the drop down to choose "Pay a Person". Follow the prompts to select the amount of money you want to send and the person to whom you wish to pay.

2. Does the person I’m sending money to need to have an Wave account?

No, the person receiving money doesn’t need to be an Wave member.

3. How do recipients actually get the money?

Recipients receive money directly into their designated bank account.

4. Will recipients be able to see my Wave FCU account information?

No, recipients only see that you have sent money to them. Your financial information is secure. Allied P2P uses the highest levels of data encryption available, and meets or exceeds all Payment Card Industry compliance standards for data protection.

5. What happens if I send money, but the recipient doesn’t get it?

You are responsible for entering the correct email address or mobile phone number for the recipient. If you type in an incorrect email address or mobile phone number, the payment can be canceled as long as the payment has not been claimed on the Allied Payment P2P system. Once the payment is claimed, it cannot be canceled.

6. How long does it take the recipient to get the money?

Recipients are notified right away that they’ve received money. The funds transfer real-time to the recipient’s account.

7. How much does it cost to send money?

It is free to send money from your Wave account using the Allied Payment P2P feature. The amount you send is debited from your Wave checking account. If you send money to family or friends, they don’t pay anything to accept the money.

8. What happens to unclaimed payments?

Within 30 days, Allied will return the unclaimed payment to Wave. Wave FCU will process a payment return and return the money to your account. -

Mobile Deposit

- What is Mobile Deposit?

- What are the advantages of using Mobile Deposit?

- Do I need to be registered for online banking to use Mobile Deposit?

- Who is eligible for Mobile Deposit?

- What mobile devices support Mobile Deposit?

- After I deposit my check with Mobile Deposit, what should I do with my check?

- When using Mobile Deposit, what types of accounts may I deposit funds into?

- When can I scan my checks into Mobile Deposit?

- What happens to unclaimed payments?

- When will deposits be posted to my account and available for use?

- Why doesn’t my current balance reflect my recent Mobile Deposit?

- How do I endorse a check when using Mobile Deposit?

- What happens if I deposit a check twice?

- What do I do if the writing on the check is too light or difficult to read?

- Can I make a loan payment through Mobile Deposit?

- What is the cost to use Mobile Deposit?

- Is Mobile Deposit safe?

- Are check images stored on my Device?

- How long can I view my Mobile Deposit History?

- What if I need assistance?

- When using Mobile Deposit, how much can I deposit into my account?

1. What is Mobile Deposit?

Mobile Deposit is a service that allows Members to send a picture of checks, taken with a smart phone, tablet or iPad, to be deposited into their accounts.

2. What are the advantages of using Mobile Deposit?

- With Mobile Deposit, you no longer need to visit a branch or an ATM to make a check deposit. You can take a photo of your check (front and back) and transmit the information electronically to Wave Federal Credit Union (FCU) for posting.

3. Do I need to be registered for online banking to use Mobile Deposit?

- Yes, you must register your account for online banking and you may use the same credentials to log into the Wave FCU App to access Mobile Deposit.

4. Who is eligible for Mobile Deposit?

- Mobile Deposit is available for Wave FCU Members who are in good standing. Mobile Deposit is available for personal and business accounts.

5. What mobile devices support Mobile Deposit?

- Mobile check deposit is supported on devices that meet the following criteria:

- Android or iPhone Touch device

- iPad (Version 2 or higher) or iPad mini

- 2 MP or higher camera

- Apple iOS 9 or higher for iPhone and iPad

- Android OS 5.0 or higher

6. After I deposit my check with Mobile Deposit, what should I do with my check?

- We recommend retaining the check until such time as the deposit is confirmed in your account.

7. When using Mobile Deposit, what types of accounts may I deposit funds into?

- You can deposit funds into either a savings account or checking account.

8. Are there any checks not eligible for Mobile Deposit?

- Yes – while most checks will process through the Mobile Deposit service, there are some exceptions. The following items are ineligible for Mobile Deposit:

- Third Party Checks – Checks payable to someone else, endorsed and signed over to you.

- Non-Negotiable Items – The online deposit of any item stamped with a "non-negotiable" watermark is PROHIBITED. Online deposits of this nature may subject you to criminal prosecution.

- Returned Checks – Any check that you deposit that is returned to us not payable as a result of insufficient funds, stop payment, or other related reasons.

- Altered Checks – Any check that contains evidence of a change (correction fluid, crossed out amounts, etc.) to information on the face of the check.

- Foreign Checks – Any check that is issued to you and drawn on a financial institution in another country (Canada, France, etc.)

- Stale Dated Checks – Certain checks contain instructions such as: "Void 90 days after issue date." If no instructions are contained, then the check is stale 6 months after the issue date.

- Post Dated Checks – Any check that is dated in the future.

- Savings Bonds

- Temporary/Starter checks, Traveler’s Checks or Money Orders.

- HELOC Access & Credit Card Advance Checks

- Checks payable to any person or entity other than the owner(s) of account

9. When can I scan my checks into Mobile Deposit?

- Checks can be scanned into Mobile Deposit 24 hours a day, 7 days a week.

10. When will deposits be posted to my account and available for use?

- Deposits made prior to 4:00 pm will post the same day. Deposits made after 4:00 pm on any weekday or on a Saturday, Sunday or Holiday, will post the next business day. All Mobile Deposits are subject to the Credit Union’s Funds Availability Policy.

11. Why doesn’t my current balance reflect my recent Mobile Deposit?

- This can occur if your deposit

- was unsuccessful.

- has not been posted to your account as deposits post once a day.

- was made after 4:00 pm Eastern Time.

- was subject to the Credit Union’s Funds Availability Policy.

PLEASE NOTE: If the back of the check is not properly endorsed, Wave FCU reserves the right to reject the check for deposit.

12. How do I endorse a check when using Mobile Deposit?

- On the back of the check, sign your name as indicated on the Pay To The Order Of line and print “For Mobile Deposit Only at WaveFCU” under your signature.

13. What happens if I deposit a check twice?

- The Mobile Deposit service will prevent the second scan from occurring and will indicate Failed with a reason code.

14. What do I do if the writing on the check is too light or difficult to read?

- The Mobile Deposit service reviews each check for image quality and to determine if the check can be read. If the check is illegible, an error message will advise you to rescan the check with good lighting.

15. Can I make a loan payment through Mobile Deposit?

- While you cannot apply a deposit directly to a loan, you can use the transfer feature available within the Mobile Banking App to make a loan payment after the check has been posted to your checking or savings account and funds become available.

16. What is the cost to use Mobile Deposit?

- There is no charge for using the Mobile Deposit service. Your account will be subject to other Credit Union fees for returned items.

- Yes. Because the mobile deposit is a service offered through the Wave FCU mobile banking app, Mobile Deposit is covered by safeguards similar to those we use to protect your privacy and security online.

18. Are check images stored on my Device?

- No. The check images are not stored on your Device but are accessible for 45 days through the Mobile Banking App. Paper check images are available from the Credit Union subject to the Credit Union’s posted fee schedule.

19. How long can I view my Mobile Deposit History?

- You are able to view 90 days of mobile deposit history, which reflects the status of the check capture (Accepted, Failed, Pending, Other). To confirm your check was deposited into your account, review your account statement or online banking history.

20. What if I need assistance?

- If the question cannot be answered through the Mobile Deposit prompts, please call us at 401-781-1020 during regular business hours for assistance.

21. When using Mobile Deposit, how much can I deposit into my account?

- You may deposit up to $5,000.00 per day.

Need Help?

And don't forget, we're here to help. Stop by a branch, give us a call at (401) 781-1020, or email us online.